Save up to 60% on corporate FX costs with Wallex

Pay, Receive, Convert and Hold FX with ease on our secure online platform

FX and Global Payments Simplified

Fuel your business with simple, low-cost and seamless cross-border solutions

Banks don't care, but we do.

Expedite your payments in 46 currencies to virtually every country with Wallex's extensive network while enjoying a seamless and fully digital experience with zero hidden charges and transparent fees.

Choose Wallex for greater speed, support, and savings on your international payments.

Supporting your business is our business

.png?width=56&height=56&name=positive-vote%20(1).png)

Preferred FX Solution of Businesses in Asia

We are the leading FX and payments specialist for B2B companies transacting in Asia. More than 43,000 companies depend on Wallex to seamlessly send, receive, convert and hold FX. Get double the value at half the cost with our customised rates and B2B-centric features available exclusively on our secure online platform.

5-star Rated Service From A Dedicated Manager

All our business customers have a dedicated account manager, based locally and available via mobile or WhatsApp to provide guidance on any query — no matter how big or small. It's earned us the Platinum service award from Feefo with over 98% positive reviews.

Customised Fees, Better than Banks

Enjoy highly competitive and transparent fees that are tailored to your business's needs. When you add in the significant FX savings from our competitive rates, you will no longer need banks or traditional remittance providers for your foreign currency needs.

-1.png?width=56&height=56&name=exchange%20(1)-1.png)

Make Easy Payments into 180 countries

Make payments into any of our 46 supported currencies covering 180+ countries from our platform. Access prime and exotic currencies like AUD, CNY, EUR, GBP, HKD, MYR, PHP, SGD, THB, USD and many more.

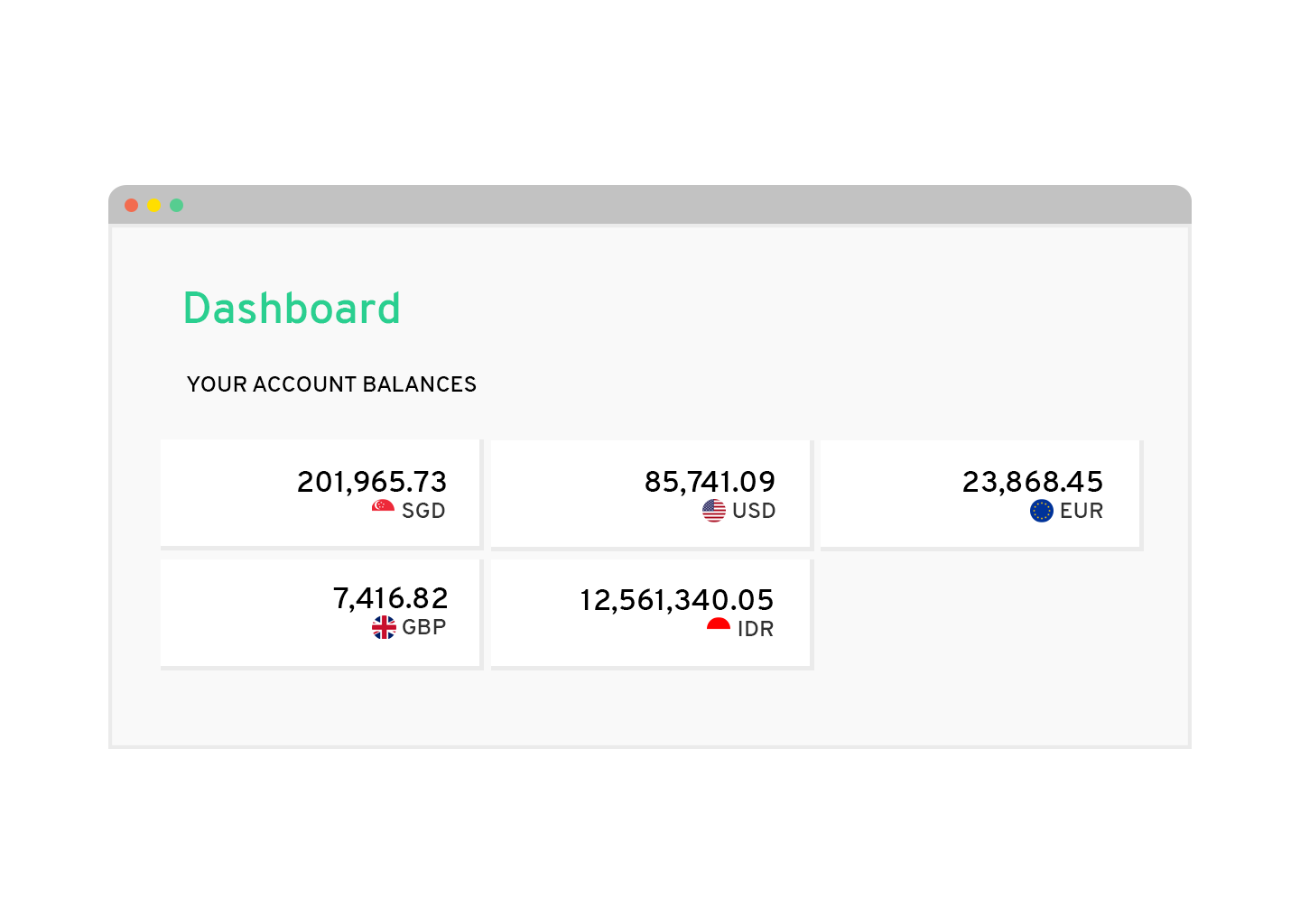

Hold FX in e-Wallet

Multi-functional Multi-currency account

Build unique, cross-border business processes to save money and time by harnessing our multi-currency wallet in tandem with our platform's key features including global payments, FX conversions, and receiving accounts.

Minimise and control your FX costs by holding multiple currencies in your multi-currency wallet. Time your payments and conversions when FX rates are favourable to you.

Experience all of this while enjoying competitive rates and fees that will help to improve your cash flows.

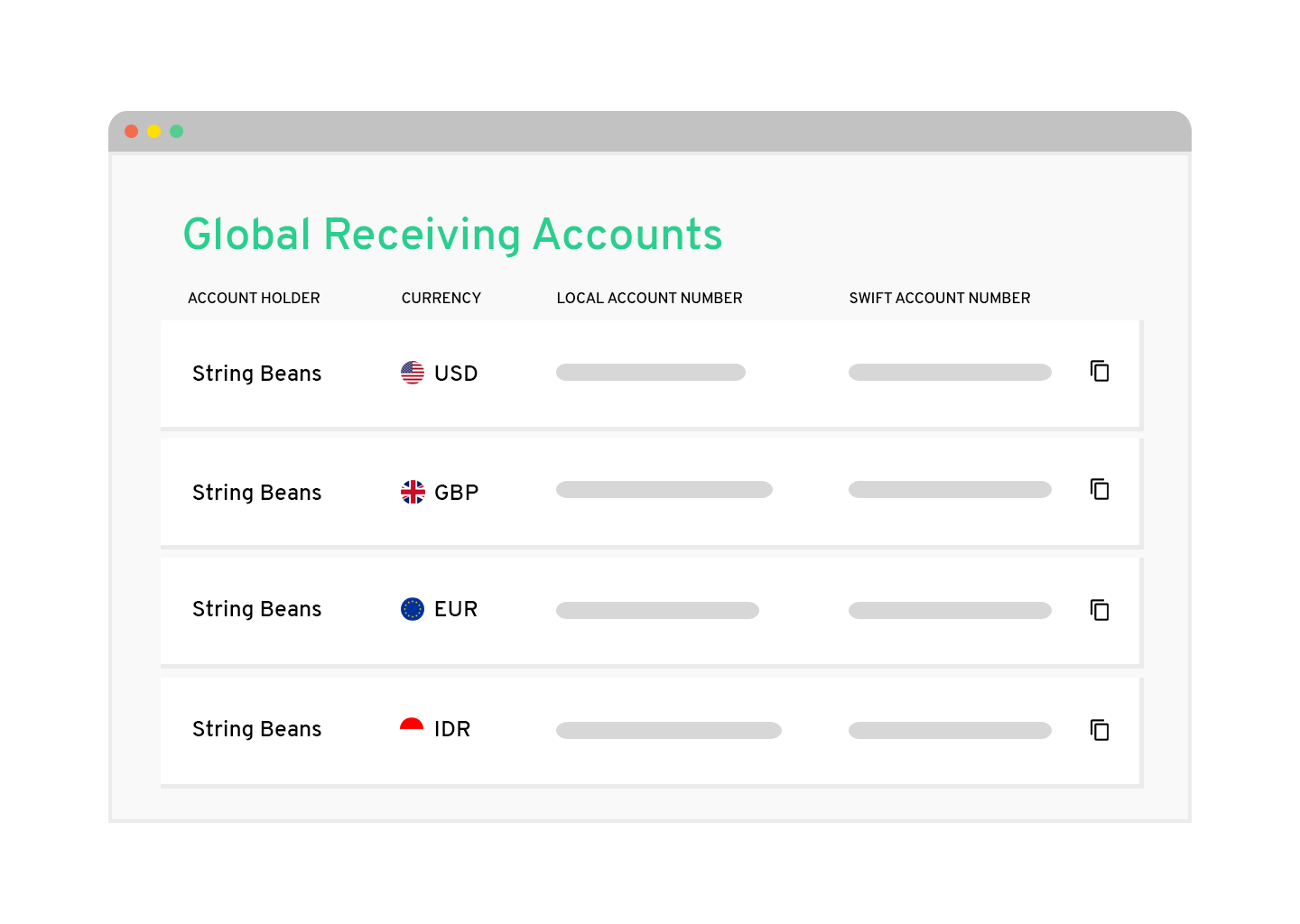

Global Receiving Accounts

The best way to receive international payments

Collect payments from anywhere in the world as if it was a local bank transfer with our Global Receiving Accounts, which gets you USD, EUR, GBP and IDR account details in your company name for free and in seconds.

Our Global Receiving Accounts enable you to accept foreign currency transfers from customers or marketplaces with the local or SWIFT clearing system.

Skip the hassle of opening bank accounts overseas, and get your payments quickly and seamlessly.

Choosing Wallex makes great business sense

| Regular Business Bank account | Multi-Currency business bank account | Wallex Account for Business | |

| What you get | You receive a single Singapore account number. Any payment in foreign currency (e.g. USD) is automatically converted to local currency i.e. SGD. |

You receive a single Singapore account number supporting selected currencies. Balances are maintained by segregated currencies in single account. |

You get personalised account numbers in multiple countries. Balances accumulated in these accounts reflect under the Wallex Wallet balance, segregated by currencies. |

| Minimum Balance requirement | Yes | Yes | No |

| Supports Foreign currencies | No | Typically supports 8 to 13 top currencies | 13 currencies to hold balance 46 currencies to make payments |

| Fees on international payments | % charge | % charge | Customised to your needs |

| FX Conversion on currency conversions | Expensive FX margin decided by Bank | Expensive FX margin decided by Bank + Fee | Transparent, bank-beating FX margins |

| Charges to you on receiving international payments | Yes | Yes |

No |

| Charges to your customer for making payment to foreign bank | Yes | Yes | No |

| # of time FX fees levied on receiving payment in 1 currency (e.g. USD) and making payment in another currency (e.g. HKD) | Not Possible | Twice | Once |

Comparison for incoming transfer via local channel

-2.jpg?width=1239&height=364&name=Logo%20Horizontal%20(2)-2.jpg)